Outline:

1: How to Choose Between ETFs and Mutual Funds: Smart, Stress-Free Financial Planning Tips for Investors

2: Understanding the Basics of Financial Planning

- Why investment choices matter

- The role of funds in your financial planning journey

- Key terms you should know before choosing

3: What Is an ETF (Exchange-Traded Fund)?

- How ETFs work

- Types of ETFs available

- Pros and cons of investing in ETFs

4: What Is a Mutual Fund?

- How mutual funds work

- Types of mutual funds available

- Pros and cons of investing in mutual funds

5: Financial Planning Considerations When Comparing ETFs and Mutual Funds

- Cost and expense ratios

- Tax efficiency and implications

- Investment flexibility and access

6: Risk Management and Diversification

- How both funds handle risk

- Asset allocation strategies

- Diversification for long-term growth

7: Liquidity and Trading Differences

- Buying and selling ETFs vs. mutual funds

- Real-time pricing vs. end-of-day NAV

- Impact on short-term financial planning

8: Accessibility and Minimum Investment Requirements

- ETFs: Easy entry, low barrier

- Mutual funds: Higher minimums, advisor-based

- What’s better for beginners?

9: Which Performs Better Over Time?

- Historical data comparison

- Active vs. passive management

- Performance consistency over decades

10: Tax Considerations in Financial Planning

- How capital gains differ

- Tax-loss harvesting opportunities

- Planning withdrawals tax-efficiently

11: Passive vs. Active Investing Styles

- Are you a hands-on or hands-off investor?

- When active funds make sense

- The rise of passive investing

12: Cost Comparison: What Are You Really Paying For?

- Expense ratios and hidden fees

- Broker commissions and fund loads

- Total cost of ownership

13: Use Cases: When to Choose ETFs vs. Mutual Funds

- Ideal scenarios for ETFs

- When mutual funds are better suited

- Mixing both in a portfolio

14: Real-Life Scenarios: Investor Profiles

- Young professional building wealth

- Retiree focused on income

- Entrepreneur with variable income

15: Financial Planning Tools to Help You Decide

- Comparison platforms and robo-advisors

- Top financial planning apps

- Working with a fiduciary advisor

16: Conclusion: Your Investment Strategy Should Fit You

17: FAQs About Choosing Between ETFs and Mutual Funds

- Can I invest in both ETFs and mutual funds?

- Do ETFs or mutual funds perform better long-term?

- Are ETFs always cheaper than mutual funds?

- Which is better for retirement planning?

- Do I need a financial advisor to invest in these funds?

How to Choose Between ETFs and Mutual Funds: Smart, Stress-Free Financial Planning Tips for Investors

READ MORE: Financial Planning for Retirement: Smart, Stress-Free Steps to Secure Your Golden Years

Understanding the Basics of Financial Planning

Before we even dive into ETFs and mutual funds, let’s address the elephant in the room: financial planning isn’t just for the rich. It’s for everyone who wants to turn their money into freedom. And choosing where to put your money—like ETFs or mutual funds—is a critical decision in your journey.

Think of it this way: your investments are like the fuel for your financial future. The right type helps you move smoothly toward your goals; the wrong one could stall your progress.

Financial planning is like building a house—you need the right materials, the right blueprint, and a solid foundation. But here’s the twist: most people skip straight to investing without even understanding the tools they’re using.

Think about it—have you ever felt stuck between choosing an ETF or a mutual fund? Maybe someone told you ETFs are “cheap and modern,” while mutual funds are “old-school but reliable.” Maybe your 401(k) is packed with mutual funds, but your friend won’t stop raving about ETFs on a trading app.

It’s confusing, right?

You’re not alone. In fact, this decision is one of the most common sticking points for new and even experienced investors. And it’s a big deal—because the choice between ETFs and mutual funds can directly impact your financial planning, tax burden, long-term growth, and even your peace of mind.

But here’s the good news: you don’t have to be a Wall Street pro to make the right choice.

This post breaks it all down—step by step, in plain English. Whether you’re just starting to invest, looking to optimize your retirement portfolio, or trying to figure out where your hard-earned money belongs, this guide will help you confidently decide which path aligns with your financial goals.

We’ll cover:

- What ETFs and mutual funds actually are (and how they work)

- Key differences in fees, risk, taxes, and flexibility

- Which one fits your investing style and life stage

- Real-life examples and tips for balancing both in your portfolio

Because here’s the truth: financial planning isn’t about picking the hottest trend. It’s about making intentional, informed choices that move you closer to financial freedom.

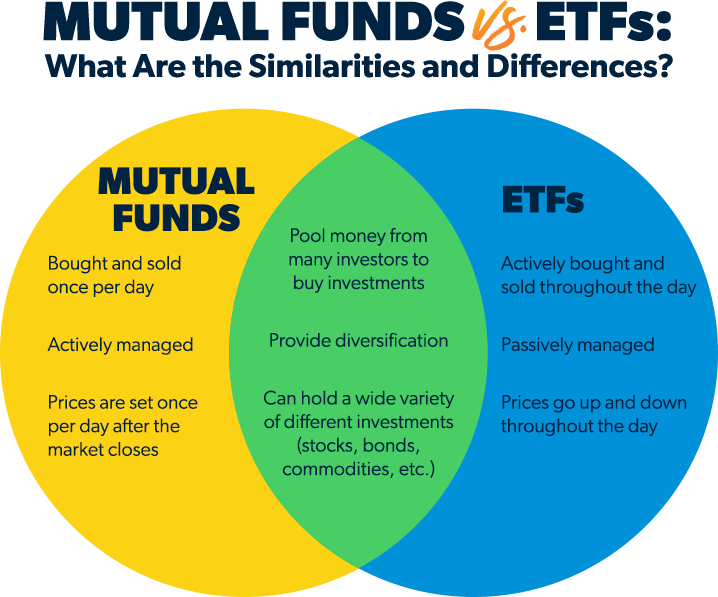

What Is an ETF (Exchange-Traded Fund)?

An ETF is like a basket of investments—stocks, bonds, or other assets—that you can buy or sell on an exchange, just like a regular stock.

Types of ETFs:

- Stock ETFs – mimic major indexes like the S&P 500

- Bond ETFs – include government or corporate bonds

- Sector ETFs – focus on industries like tech or energy

- Commodity ETFs – track gold, oil, etc.

Pros of ETFs:

- Low fees

- Highly liquid (you can buy/sell anytime during market hours)

- Great for tax efficiency

- Transparent holdings

Cons of ETFs:

- Real-time trading may tempt you to “time” the market

- Slightly complex for beginners

- Brokerage account required

What Is a Mutual Fund?

A mutual fund pools money from many investors and is managed by a fund manager who allocates the money into a mix of stocks, bonds, or other assets.

Types of Mutual Funds:

- Equity mutual funds

- Bond mutual funds

- Money market funds

- Target-date retirement funds

Pros of Mutual Funds:

- Professionally managed

- Ideal for long-term passive investors

- Easy to automate with 401(k)s and IRAs

Cons of Mutual Funds:

- Higher fees

- Only priced once per day (no intra-day trading)

- Less tax-efficient

- Minimum investment requirements

Financial Planning Considerations When Comparing ETFs and Mutual Funds

Cost and Expense Ratios

ETFs often have lower fees. Many ETFs charge less than 0.10%, while mutual funds may charge 0.50% or more.

Tax Efficiency

ETFs are more tax-efficient due to their unique structure. Mutual funds can pass capital gains taxes to investors annually.

Access and Flexibility

ETFs win here—they can be bought/sold in seconds. Mutual funds? One price a day after markets close.

Risk Management and Diversification

Both ETFs and mutual funds offer strong diversification—but how they manage risk differs.

- ETFs let you target specific sectors and adjust quickly

- Mutual funds often follow a balanced, hands-off strategy

Your financial planning goals will determine which fits your comfort level.

Liquidity and Trading Differences

ETFs:

- Trade like stocks

- Price changes throughout the day

- Can set stop-loss or limit orders

Mutual Funds:

- Priced once daily (NAV)

- Trades are executed at day’s end

- No real-time trading flexibility

Accessibility and Minimum Investment Requirements

ETFs: You can start with $10 or less through fractional shares

Mutual Funds: Often require $500–$3,000 minimum investment

For new investors or young professionals, ETFs are generally easier to access.

Which Performs Better Over Time?

It depends.

- ETFs usually follow index strategies, matching market returns

- Mutual Funds can outperform, but only if the manager is skilled (and consistent)

Historical data shows that low-fee ETFs often beat high-fee mutual funds over time—especially after costs and taxes.

Tax Considerations in Financial Planning

If you’re looking to build wealth and minimize taxes:

- ETFs are more tax-efficient due to in-kind transfers

- Mutual funds may distribute capital gains—even if you didn’t sell anything

Use ETFs in taxable accounts, and mutual funds in IRAs or 401(k)s.

Passive vs. Active Investing Styles

Are you someone who likes to “set it and forget it”?

- Go with ETFs for passive investing

- Choose mutual funds if you believe in professional fund managers or want personalized strategies

But remember: 80% of active funds underperform their benchmarks over time.

Cost Comparison: What Are You Really Paying For?

- ETF Expense Ratio: Often 0.03% to 0.20%

- Mutual Fund Expense Ratio: Typically 0.50% to 1.50%

- Load Fees (Mutual Funds): Some charge 3–5% just to buy in!

Lower costs mean more money compounding for you.

Use Cases: When to Choose ETFs vs. Mutual Funds

Choose ETFs if:

- You want low costs

- You’re trading in a taxable account

- You value liquidity and flexibility

Choose Mutual Funds if:

- You’re investing in a 401(k) or employer plan

- You want a passive long-term set-it-and-forget-it strategy

- You value professional management

Real-Life Scenarios: Investor Profiles

Young Investor (Age 25):

ETFs offer growth, low cost, and liquidity—perfect for long-term compounding.

Middle-Aged Couple:

Balanced mutual funds can reduce risk and simplify management.

Near-Retiree (Age 60+):

Use a mix of both for diversification and tax efficiency.

Financial Planning Tools to Help You Decide

Need help choosing?

Try these tools:

- Morningstar Fund Comparison Tool

- Fidelity ETF/Mutual Fund Screener

- Betterment and Wealthfront for automated advice

Or, speak to a fiduciary financial planner to create a custom strategy.

Conclusion:

Your Investment Strategy Should Fit You

When it comes to financial planning, there’s no one-size-fits-all.

ETFs and mutual funds both offer incredible tools for growing your wealth—but the right choice depends on your goals, budget, risk tolerance, and investment style.

Think of ETFs as the smart, efficient, DIY route. Mutual funds are more like hiring a chauffeur—you let someone else do the driving.

The bottom line? Choose the vehicle that gets you closer to your goals with less stress and more confidence.

Choosing between ETFs and mutual funds isn’t just about chasing the highest returns or picking the most popular option—it’s about choosing what works for you and your long-term financial planning goals.

You see, the path to financial independence isn’t paved with shortcuts. It’s paved with smart decisions, made consistently over time. And understanding the difference between ETFs and mutual funds is one of those smart decisions that sets the tone for how you build and preserve your wealth.

Are you someone who likes to keep it simple, low-cost, and hands-off? ETFs might be your perfect match.

Do you prefer a professionally managed portfolio that aligns with a retirement goal or investment philosophy? Mutual funds could be the right fit.

But here’s the real secret: You don’t have to choose just one.

Many savvy investors use both—leveraging the strengths of each to build a resilient, diversified portfolio. That’s the beauty of financial planning. It’s not rigid or one-size-fits-all. It’s flexible. Personal. Empowering.

So, what’s your next step?

Take a moment to look at your current investments. Ask yourself:

- Are they aligned with my goals?

- Am I paying unnecessary fees?

- Is my portfolio diversified and tax-efficient?

If you don’t like the answers, it’s time to pivot. Because the earlier you make intentional choices, the more freedom you’ll enjoy down the road—whether that’s early retirement, funding your children’s education, traveling the world, or simply sleeping well at night.

Financial planning is not about being perfect. It’s about being prepared.

So choose wisely. Review regularly. And invest confidently, knowing you’ve equipped yourself with the knowledge that turns money into freedom—and goals into reality.

FAQs

About Choosing Between ETFs and Mutual Funds

1. Can I invest in both ETFs and mutual funds?

Absolutely. In fact, a balanced portfolio might include both—each serves different purposes.

2. Are ETFs always cheaper than mutual funds?

Generally, yes—but compare each fund’s total cost, including commissions and expense ratios.

3. Do ETFs or mutual funds perform better long-term?

ETFs often match market returns with low costs, while mutual funds might beat the market—but fees can eat up gains.

4. Which is better for retirement planning?

Both can work. Use mutual funds in your 401(k), and ETFs in your Roth IRA or taxable accounts.

5. Do I need a financial advisor to invest in these funds?

No, but working with a fiduciary advisor can help align your investments with your goals—especially if you’re new to financial planning.