Outline:

- Introduction

1.1 How to Organize Your Tax Documents for Easy Filing Tax

1.2 What You Will Learn from This Guide - Understanding the Importance of Organized Tax Records

2.1 Benefits of Organized Tax Documents

2.2 The Risks of Disorganized Tax Papers - Types of Tax Documents You Need to Organize

3.1 Income Statements (W-2s, 1099s)

3.2 Deduction and Expense Receipts

3.3 Investment and Bank Statements

3.4 Previous Tax Returns

3.5 Other Relevant Documents (e.g., mortgage statements, education expenses) - Setting Up Your Tax Document Organization System

4.1 Choosing Between Physical and Digital Organization

4.2 Necessary Tools and Supplies for Organizing Tax Documents

4.3 Creating a Filing Structure That Works for You - How to Categorize Your Tax Documents Effectively

5.1 Income Documents

5.2 Expense and Deduction Documents

5.3 Credits and Other Financial Records

5.4 Legal and Miscellaneous Tax Records - Creating a Tax Calendar to Stay on Track

6.1 Important Tax Dates to Remember

6.2 Scheduling Regular Document Reviews and Updates

6.3 How a Tax Calendar Improves Organization - Digitizing Your Tax Documents for Easy Access

7.1 Best Practices for Scanning and Storing Documents

7.2 Recommended Apps and Software for Digital Filing

7.3 Securing Your Digital Tax Files - Tips for Maintaining Your Tax Document System Year-Round

8.1 Establishing a Monthly Review Routine

8.2 Handling New Documents as They Arrive

8.3 Avoiding Common Pitfalls in Tax Document Management - How to Prepare Your Organized Documents for Tax Filing

9.1 Checking for Completeness and Accuracy

9.2 Sharing Documents with Your Tax Preparer or Using Tax Software

9.3 Backup and Safety Measures - Special Considerations for Freelancers and Small Business Owners

10.1 Tracking Business-Related Income and Expenses

10.2 Organizing Receipts and Invoices

10.3 Managing Estimated Tax Payments - How Organizing Tax Documents Saves You Money

11.1 Avoiding Late Fees and Penalties

11.2 Maximizing Deductions and Credits

11.3 Reducing Audit Risks - Using Technology to Simplify Tax Document Organization

12.1 Cloud Storage Solutions

12.2 Automated Document Capture Tools

12.3 Integrating Financial Accounts for Automatic Data Import - How to Handle Tax Documents After Filing

13.1 How Long to Keep Tax Records

13.2 Organizing for Future Audits or Amendments

13.3 Safe Disposal of Old Tax Documents - Common Mistakes to Avoid When Organizing Tax Documents

14.1 Procrastinating on Organization

14.2 Mixing Personal and Business Documents

14.3 Ignoring Backup Systems - Conclusion

15.1 Summary of Steps to Organize Your Tax Documents for Easy Filing

15.2 Encouragement to Start Organizing Today for Stress-Free Tax Seasons - FAQs

16.1 What’s the best way to start organizing tax documents if I’m behind?

16.2 How long should I keep my tax documents?

16.3 Can I organize tax documents digitally only?

16.4 What documents are essential for tax filing?

16.5 How often should I update my tax document system?

READ MORE: planning-taxes-for-your-small-business

How to Organize Your Tax Documents for Easy Filing Tax: 15 Powerful Strategies for Stress-Free Tax Season

Introduction

Why Organizing Tax Documents Matters

A well-organized tax filing system can drastically reduce stress and mistakes. It makes tax preparation faster and ensures you don’t miss out on any crucial deductions or credits. Being organized also protects you if you’re ever audited by providing quick access to all necessary documents.

How to Organize Your Tax Documents for Easy Filing Tax

This guide focuses on how to organize your tax documents for easy filing tax, sharing clear steps to help you build an efficient, reliable system for tax record management.

What You Will Learn from This Guide

You’ll discover what tax documents to keep, how to categorize and store them, tools for digitization, and maintenance tips for year-round organization.

Understanding the Importance of Organized Tax Records

Benefits of Organized Tax Documents

- Saves time during tax season

- Ensures accuracy in filing

- Helps maximize deductions and credits

- Simplifies communication with tax professionals

- Protects against penalties and audits

The Risks of Disorganized Tax Papers

- Missing important deductions

- Filing errors leading to audits or penalties

- Stress and last-minute scrambling

- Loss or damage of essential documents

Types of Tax Documents You Need to Organize

Income Statements (W-2s, 1099s)

Documents showing your earnings from employers, clients, or investments.

Deduction and Expense Receipts

Receipts related to deductible expenses like medical bills, charitable donations, and business costs.

Investment and Bank Statements

Documents showing dividends, interest income, and transactions relevant to your taxes.

Previous Tax Returns

Keeping copies of past tax returns helps with preparation and audits.

Other Relevant Documents

Mortgage interest statements, student loan interest forms, education expenses, and more.

Setting Up Your Tax Document Organization System

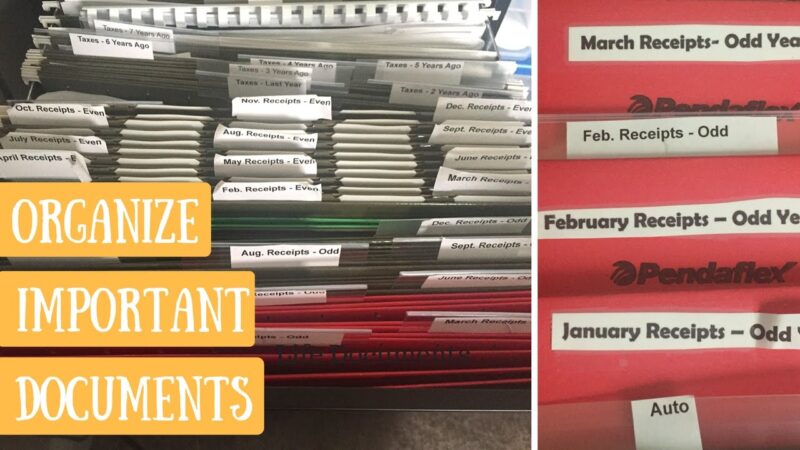

Choosing Between Physical and Digital Organization

Assess what works best for your lifestyle: physical folders, digital files, or a hybrid system.

Necessary Tools and Supplies for Organizing Tax Documents

Folders, binders, labels, scanners, cloud storage subscriptions.

Creating a Filing Structure That Works for You

Develop a simple, logical system—by year, document type, or tax category.

How to Categorize Your Tax Documents Effectively

Income Documents

W-2s, 1099s, investment income.

Expense and Deduction Documents

Medical expenses, charitable giving, education.

Credits and Other Financial Records

Childcare expenses, energy credits.

Legal and Miscellaneous Tax Records

Correspondence with the IRS, tax notices.

Creating a Tax Calendar to Stay on Track

Important Tax Dates to Remember

Deadlines for filing, estimated payments.

Scheduling Regular Document Reviews and Updates

Monthly or quarterly check-ins.

How a Tax Calendar Improves Organization

Keeps you proactive and prevents last-minute panic.

Digitizing Your Tax Documents for Easy Access

Best Practices for Scanning and Storing Documents

High-resolution scans, consistent file naming.

Recommended Apps and Software for Digital Filing

Evernote, Google Drive, Dropbox.

Securing Your Digital Tax Files

Use passwords, two-factor authentication, encrypted storage.

Tips for Maintaining Your Tax Document System Year-Round

Establishing a Monthly Review Routine

Review new documents regularly to avoid pile-ups.

Handling New Documents as They Arrive

File immediately or scan digitally.

Avoiding Common Pitfalls in Tax Document Management

Don’t mix personal and business files, avoid procrastination.

How to Prepare Your Organized Documents for Tax Filing

Checking for Completeness and Accuracy

Make sure nothing is missing.

Sharing Documents with Your Tax Preparer or Using Tax Software

Organize files in an easy-to-understand format.

Backup and Safety Measures

Keep copies in multiple locations.

Special Considerations for Freelancers and Small Business Owners

Tracking Business-Related Income and Expenses

Separate business from personal finances.

Organizing Receipts and Invoices

Use apps like QuickBooks or Expensify.

Managing Estimated Tax Payments

Keep proof of payments organized.

How Organizing Tax Documents Saves You Money

Avoiding Late Fees and Penalties

Timely filing prevents extra charges.

Maximizing Deductions and Credits

Complete documentation ensures you claim all eligible benefits.

Reducing Audit Risks

Proper records provide proof if questioned.

Using Technology to Simplify Tax Document Organization

Cloud Storage Solutions

Benefits of Google Drive, Dropbox.

Automated Document Capture Tools

Apps that scan and categorize receipts.

Integrating Financial Accounts for Automatic Data Import

Bank syncing with budgeting software.

How to Handle Tax Documents After Filing

Once you’ve successfully filed your taxes, many people assume their work with tax documents is over. However, proper handling of tax records after filing is just as crucial as organizing them beforehand. Keeping your tax documents well-managed after filing helps you stay prepared for audits, amendments, and future financial planning. It also ensures you comply with legal record-keeping requirements and protects you from identity theft.

Here’s a comprehensive guide on how to handle tax documents after filing to keep your finances secure and organized long-term.

1. Understand How Long to Keep Tax Records

The IRS and tax authorities have guidelines on how long you should retain tax documents:

- General Rule: Keep tax returns and supporting documents for at least three years from the date you filed the return or the due date of the return, whichever is later. This is the period during which the IRS can typically audit your return.

- Extended Periods:

- Keep records for six years if you underreported income by more than 25%.

- Keep records for seven years if you claim a loss from worthless securities or bad debt deduction.

- Keep records indefinitely if you failed to file a return or filed a fraudulent return.

Understanding these timelines helps you avoid prematurely destroying records that you may need later.

2. Organize Your Tax Documents for Easy Access

Even after filing, your documents should be stored in a way that makes them easy to retrieve if needed:

- Physical Records: Use clearly labeled folders or binders by tax year, separating income, deductions, credits, and correspondence. Store them in a secure, dry place such as a locked filing cabinet or safe.

- Digital Records: For scanned documents and electronic files, maintain an organized folder system on a secure cloud platform or external hard drive. Use consistent file names that include the tax year and document type.

Keeping your records organized reduces stress if you’re ever asked for documentation by the IRS or a tax preparer.

3. Backup Your Tax Records

Loss of tax documents due to fire, theft, or computer failure can be disastrous. Protect your tax files by:

- Creating Digital Backups: Scan all physical tax documents and store them securely online or on encrypted external drives.

- Using Multiple Storage Locations: Avoid keeping all records in one place. For example, keep physical copies at home and digital backups in the cloud.

This redundancy ensures you won’t lose important tax documents and helps you recover quickly if something happens.

4. Be Prepared for Amendments

Sometimes after filing, you may realize you made an error or forgot to include a deduction or credit. Keeping your records organized makes it easier to amend your tax return:

- Locate the relevant documents quickly.

- Provide accurate information when filing amendments.

- Keep track of any additional paperwork related to the amendment.

Amending a return is simpler and less stressful with good record management.

5. Responding to IRS Notices or Audits

If the IRS contacts you with questions or initiates an audit, you’ll need to provide proof supporting your tax filings. Well-maintained records will:

- Help you quickly gather requested documentation.

- Allow you to verify the accuracy of your original return.

- Facilitate communication with the IRS or your tax advisor.

If you’re missing documents, you may face penalties or delays. Good record-keeping protects you from these risks.

6. Secure Disposal of Old Tax Documents

Once the retention period expires, it’s important to dispose of tax documents safely to prevent identity theft:

- Shred Physical Documents: Use a cross-cut shredder to destroy paper records containing sensitive information.

- Delete Digital Files Securely: Use secure deletion software to remove electronic records permanently.

Avoid simply throwing tax documents in the trash or deleting files without secure methods.

7. Keeping Track of Non-Tax Financial Documents

Although this guide focuses on tax documents, keeping related financial records—like investment statements, mortgage documents, and insurance policies—is also important. These may impact future tax filings or financial planning.

8. Tips for Maintaining Your Document System Year-Round

- Schedule annual reviews to purge outdated documents after safe retention periods.

- Update digital folders regularly as you file new returns.

- Keep correspondence with tax professionals organized alongside tax records.

Handling your tax documents properly after filing is a crucial step toward financial security and peace of mind. Knowing how long to keep records, organizing them for easy access, backing them up, and disposing of them securely protects you from audits, identity theft, and filing errors. By maintaining a solid post-filing document management system, you’ll be well-prepared for future tax seasons and any unexpected situations that arise.

READ MORE: Mastering Tax Season: How to Organize Your Documents for a Stress-Free Filing | Highland Financial Advisors

Common Mistakes to Avoid When Organizing Tax Documents

Organizing your tax documents effectively is key to a smooth, stress-free tax filing process. However, many people unknowingly make mistakes that can lead to confusion, lost deductions, or even penalties. Avoiding these common pitfalls will help you maintain an organized system that saves time, reduces errors, and maximizes your tax benefits. Here are the most frequent mistakes to watch out for and how to steer clear of them.

1. Procrastinating Organization Until Tax Season

One of the biggest mistakes is waiting until the last minute to organize your tax documents. When you pile everything up until the final days before filing, it creates unnecessary stress and increases the chances of missing important paperwork.

How to avoid:

Set a schedule to collect and file documents regularly—monthly or quarterly. This habit keeps things manageable and prevents the overwhelming scramble that tax season often brings.

2. Mixing Personal and Business Documents

If you have separate personal and business finances, combining all documents in one place can create chaos and confusion. Mixing receipts, invoices, and statements makes it difficult to track deductible business expenses and could lead to errors or missed deductions.

How to avoid:

Maintain separate filing systems for personal and business tax documents. Use clear labels and dedicated folders or digital directories to keep them distinct.

3. Failing to Back Up Important Documents

Losing tax documents due to misplaced papers or computer crashes can cause headaches and delay your filing. Not having backups increases the risk of permanent loss, which is especially problematic if you’re audited or need to amend past returns.

How to avoid:

Create both physical and digital backups of all important tax records. Use cloud storage services like Google Drive or Dropbox for digital copies, and store physical backups in a safe, secure location.

4. Not Keeping Receipts and Proof of Expenses

Receipts and proof of expenses are crucial for substantiating deductions and credits. Many taxpayers discard receipts too early or fail to collect them systematically, risking denial of deductions during audits.

How to avoid:

Develop a habit of immediately filing receipts as you receive them. Use receipt scanning apps or a simple envelope system to track expenses throughout the year.

5. Using an Overly Complex or Inconsistent Filing System

Sometimes people try to create elaborate filing systems that are difficult to maintain or inconsistent labeling that confuses rather than clarifies.

How to avoid:

Keep your filing system simple, intuitive, and consistent. Use clear folder names, color coding, or digital tags that make retrieval quick and easy.

6. Forgetting to Include All Income Sources

Tax returns must include income from all sources—employment, freelance work, investments, rental properties, and more. Missing income documents can lead to audits and penalties.

How to avoid:

Keep track of all income streams throughout the year and organize related documents in one place to ensure nothing is overlooked.

7. Ignoring Tax Notices and Correspondence

Many taxpayers throw away or overlook tax notices, letters, or amendments from tax authorities. These documents may contain critical information or require action.

How to avoid:

Create a special folder for all tax-related correspondence and review them promptly to address any issues or requests.

8. Not Reviewing Documents for Accuracy Before Filing

Filing tax returns with inaccurate or incomplete information can trigger audits or delays.

How to avoid:

Review all tax documents carefully before filing. Check that names, Social Security numbers, and amounts match your records.

9. Neglecting to Organize Prior Year Tax Returns

Past tax returns are important for reference, especially when dealing with carryover deductions, audits, or loan applications. Misplacing these can complicate financial matters.

How to avoid:

Store prior year returns in a designated, easy-to-access location, both physically and digitally.

10. Overlooking Digital Security for Tax Documents

Digital tax documents are vulnerable to theft or loss if not properly secured.

How to avoid:

Use strong passwords, enable two-factor authentication on cloud storage accounts, and avoid storing sensitive documents on unsecured devices.

11. Not Having a Backup Plan for Document Loss

Accidents happen—fires, floods, or device failures can destroy your tax records.

How to avoid:

Regularly back up your documents to multiple locations, including physical copies in a safe and encrypted cloud services.

12. Failing to Keep Documents for the Recommended Period

The IRS typically recommends keeping tax records for at least three years, but certain documents might need longer retention.

How to avoid:

Know how long to keep each type of tax document and set reminders to review and safely dispose of older documents as appropriate.

13. Relying Solely on Memory or Verbal Notes

Relying on your memory to recall expenses or income details is risky and can lead to mistakes.

How to avoid:

Document every transaction, keep detailed notes, and file related receipts and statements systematically.

14. Mixing Tax Documents With Non-Tax Financial Records

Not all financial documents are relevant to taxes, and mixing them can cause clutter.

How to avoid:

Only file documents related directly to your tax filing in your tax folders; keep personal financial records separate.

15. Ignoring the Benefits of Digitization

Some taxpayers resist digital organization and rely solely on paper, which can be less efficient and prone to loss.

How to avoid:

Adopt digital tools to scan, store, and organize tax documents securely. Digital organization offers faster retrieval, less clutter, and easier sharing with tax preparers.

Avoiding these common mistakes when organizing your tax documents will save you time, reduce stress, and help you maximize your tax savings. A clean, consistent, and secure filing system is the backbone of successful tax management. By staying proactive and organized, you’ll face tax season with confidence and peace of mind.

Conclusion

Organizing your tax documents is not just about neatness—it’s a powerful strategy for reducing stress, avoiding errors, and saving money. By following these 15 powerful strategies, you can create an effective system tailored to your needs, ensuring you’re ready for tax season every year. The sooner you start organizing, the easier your tax journey will be. So grab those papers, choose your tools, and take control of your tax documents today for a smoother, more confident filing experience.

FAQs

1. What’s the best way to start organizing tax documents if I’m behind?

Start by gathering all documents in one place, then sort by year and category. Digitize as you go to reduce clutter.

2. How long should I keep my tax documents?

Generally, keep tax records for at least three years, longer if you have property or ongoing audits.

3. Can I organize tax documents digitally only?

Yes, many prefer digital-only systems for accessibility and security, but ensure proper backups.

4. What documents are essential for tax filing?

Income statements, deduction receipts, investment documents, prior returns, and relevant legal notices.

5. How often should I update my tax document system?

Monthly or quarterly updates keep your system manageable and prevent end-of-year chaos.