Introduction: Breaking the Cycle of Struggle

In most African homes, the death of a breadwinner is not just emotional—it’s financially devastating. Families sell property at giveaway prices, children are pulled out of school, and debts pile up. In Nigeria, it’s common to hear, “If only he had life insurance, things would have been different.”

In contrast, in the United States and Canada, life insurance has quietly powered the transfer of wealth from one generation to another. While many Africans see it as an expense, Americans often see it as an asset. This difference explains why some families stay wealthy for centuries, while others fall into cycles of poverty.

This article unpacks how life insurance can serve as a powerful tool for building generational wealth across Nigeria, Africa, Europe, and America. We’ll explore the pain points families face, compare global approaches, and show you practical ways to turn life insurance into a wealth engine.

Why Generational Wealth Matters More Than Ever

Generational wealth is more than property or money—it’s a legacy. In Africa, poverty often resets every generation because wealth is rarely transferred successfully. In America and Europe, children inherit not just money but businesses, education funds, and trust accounts.

Without a plan, even the wealthiest family can fall apart within one generation. Studies show that 70% of wealthy families lose their wealth by the second generation, and 90% by the third. Life insurance is one of the simplest ways to prevent this tragedy because it bypasses the chaos of inheritance battles and provides immediate cash.

The Pain Points Families Face Without Life Insurance

Here’s a breakdown of the financial pain points experienced in different regions:

Nigeria & Africa

- Families sell ancestral land or houses to cover hospital bills and funerals.

- Children abandon school due to lack of tuition.

- Breadwinner’s debts are inherited, leaving families worse off.

- Dependence on extended family for survival leads to conflict and shame.

Europe

- While social safety nets exist, taxes on estates can consume large portions of inherited wealth.

- Families without insurance often face delays in accessing funds due to lengthy probate.

America

- Families with no insurance are forced into GoFundMe campaigns just to cover funeral costs.

- Without planning, estate taxes can erode wealth.

- Medical bills in the U.S. can cripple survivors if not covered.

Canada

- Life insurance is vital because the government doesn’t fully cover all financial needs.

- Policies help ensure children’s education and mortgages are not disrupted.

👉 Pain point solution: Life insurance creates an instant financial cushion. It prevents forced asset sales, secures education, and ensures family dignity.

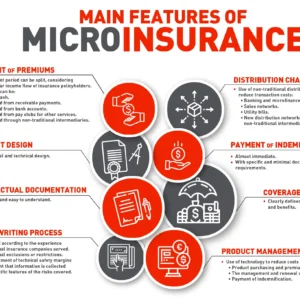

Life Insurance Explained Simply

Many people avoid life insurance because they don’t understand it. Let’s simplify.

- Term Life Insurance: Cheap, covers you for a set period (10–30 years). No savings.

- Whole Life Insurance: Permanent, more expensive, but builds savings (“cash value”).

- Universal Life Insurance: Flexible premiums, investment-linked, grows faster.

- Endowment Policies: Popular in Africa/Asia; combine protection with forced savings.

- Family Income Benefit: Pays monthly income to survivors instead of a lump sum.

Think of term life as renting insurance, while whole life is like owning insurance plus a savings account.

Table: Life Insurance Options Across Regions

| Type | Best For | Wealth-Building Potential | Popular In |

|---|---|---|---|

| Term Life | Young families, low budgets | Basic payout only | Nigeria, Africa, USA entry-level |

| Whole Life | Legacy planning | Savings + guaranteed payout | USA, Canada, Europe |

| Universal Life | Flexible & investment growth | High potential wealth | USA, Europe |

| Endowment Plans | Savings + coverage combo | Medium wealth creation | Nigeria, Africa, India |

| Family Income Benefit | Monthly lifestyle protection | Sustains family income | Nigeria, South Africa |

How Life Insurance Builds Generational Wealth

Here’s how it works step by step:

- Immediate Liquidity – Insurance pays cash instantly, unlike assets that may take years to sell.

- Debt Protection – Clears mortgages, student loans, or hospital bills.

- Education Funding – Children continue schooling without disruption.

- Business Continuity – Family businesses don’t collapse when the owner dies.

- Tax-Free Inheritance – In most countries, payouts bypass taxes.

- Peace of Mind – Survivors focus on healing, not hustling for money.

Generational Wealth in Nigeria and Africa

- Challenges: Low trust in insurance companies, lack of awareness, and economic hardship.

- Opportunities: Even small policies (₦1M–₦5M coverage) can change lives.

- Case Study: In Lagos, a man with a ₦3M term policy passed away suddenly. The payout cleared his debts and paid for his daughter’s university education.

Generational Wealth in Europe

- Families integrate insurance with estate planning.

- Policies help offset heavy inheritance taxes.

- Example: In the U.K., high-net-worth individuals use life insurance trusts to transfer millions without tax penalties.

Generational Wealth in America

- Life insurance is a tax hack. Wealthy families buy huge policies, then borrow against them to fund investments while still alive.

- Policies can be used to create family banks—where future generations borrow for business or education at low interest.

- Example: Walt Disney reportedly used insurance loans to fund Disneyland in the 1950s.

Generational Wealth in Canada

- Families blend life insurance with registered savings plans.

- Whole life policies are used to pay for university and pass tax-free inheritances.

- Many immigrant families in Canada buy policies as a way to build generational roots.

Excuses People Give—and Why They’re Dangerous

- “It’s too expensive.” – Reality: Term life in the U.S. costs less than Netflix per month.

- “Insurance companies don’t pay.” – Regulated firms must pay valid claims by law.

- “I’m too young.” – The younger you are, the cheaper it is. Waiting only increases costs.

- “It’s for the rich.” – In Africa, even ₦1M can cover burial costs and prevent family debt.

How to Start Building Generational Wealth with Insurance

- Assess your needs – Calculate 10–15x your annual income.

- Choose the right type – Start with term life, then upgrade to whole or universal.

- Add riders – Critical illness, accidental death, or disability riders.

- Review regularly – Update beneficiaries and coverage as your income grows.

- Work with trusted providers – Avoid unlicensed companies.

Emotional Power of Life Insurance

Money is emotional. Life insurance provides dignity to your family, prevents shameful dependence, and ensures your legacy lives on. For African cultures where family honor is key, insurance can mean the difference between respect and ridicule.

Conclusion: Don’t Delay Your Legacy

Generational wealth isn’t built overnight—it’s built by decisions. Life insurance is not about death; it’s about life, love, and legacy. Whether you’re in Nigeria, Africa, Europe, or America, the principle remains the same: protect your family today to empower them tomorrow.

FAQs

1. What’s the best type of life insurance for beginners?

Term life insurance is affordable and provides immediate protection.

2. Can life insurance replace investments?

No, but it complements them by providing guaranteed protection and tax-free inheritance.

3. How much coverage should I buy?

At least 10–15 times your annual salary.

4. Is life insurance payout taxable?

In most regions, payouts are tax-free, making it an ideal tool for wealth transfer.

5. At what age should I buy?

The earlier, the better—premiums are lowest when you’re young and healthy.