Outline:

Introduction

1.1 Why Teaching Kids About Money Management Is Crucial

1.2 Common Financial Mistakes Adults Make Due to Lack of Early Education

1.3 What You’ll Gain from This Guide

- Understanding the Basics of Money Management for Kids

2.1 What Is Money Management?

2.2 How to Teach Kids About Money Management from an Early Age

2.3 Age-Appropriate Financial Concepts - Setting the Foundation: Teaching Young Kids (Ages 3-7)

3.1 Introducing the Concept of Money

3.2 Using Play to Teach Money Skills

3.3 Simple Activities to Build Awareness - Teaching Elementary-Aged Kids (Ages 8-12) About Money

4.1 Explaining Saving, Spending, and Sharing

4.2 Introducing Allowances and Budgeting

4.3 Using Real-Life Experiences and Games - Money Management for Teens (Ages 13-18)

5.1 Teaching About Earning Money

5.2 Managing a Bank Account and Digital Payments

5.3 Credit, Debt, and Responsible Borrowing - Effective Tools and Resources to Teach Kids About Money

6.1 Books and Educational Apps

6.2 Money Jars, Piggy Banks, and Visual Aids

6.3 Family Financial Discussions - Role Modeling and Setting Good Financial Habits

7.1 Leading by Example

7.2 Involving Kids in Family Budgeting

7.3 Encouraging Questions and Open Conversations - Using Allowances to Teach Financial Responsibility

8.1 Setting Up an Allowance System

8.2 Guidelines for Allowance Management

8.3 Teaching Delayed Gratification and Goal Setting - Incorporating Technology in Teaching Money Management

9.1 Kid-Friendly Banking Apps

9.2 Online Games That Teach Financial Literacy

9.3 Monitoring and Guiding Digital Spending - Common Challenges Parents Face When Teaching Money and How to Overcome Them

10.1 Dealing with Impulsive Spending

10.2 Avoiding Money Taboo Topics

10.3 Balancing Fun and Responsibility - Encouraging Entrepreneurship and Earning

11.1 Simple Business Ideas for Kids

11.2 Teaching the Value of Hard Work

11.3 Managing Earnings Wisely - The Importance of Teaching Giving and Charity

12.1 Instilling Empathy Through Sharing

12.2 Practical Ways to Give Back

12.3 Balancing Spending and Generosity - Financial Education in Schools: What’s Missing and How Parents Can Fill the Gap

13.1 Overview of Current Curriculum

13.2 Supplementing With Home Education

13.3 Advocating for Better Financial Literacy - Measuring Progress and Celebrating Financial Milestones

14.1 Setting Financial Goals with Kids

14.2 Recognizing Achievements

14.3 Keeping Motivation High - Conclusion

15.1 Summary of Key Steps to Teach Kids About Money Management

15.2 Encouragement to Start Early and Stay Consistent - FAQs

16.1 At what age should I start teaching my child about money?

16.2 How much allowance is appropriate for kids?

16.3 How do I talk to my teenager about credit cards?

16.4 What are the best apps for teaching kids about money?

16.5 How can I encourage my child to save rather than spend?

READ MORE: How To Effectively Pitch A Business Idea

How to Teach Kids About Money Management from an Early Age: 15 Powerful Tips to Build Lifelong Financial Skills

Teaching kids about money management from an early age is one of the greatest gifts you can give them. When children learn how to handle money wisely, they grow up confident, responsible, and prepared for the financial challenges of adulthood. Unfortunately, many adults struggle with money simply because they missed out on early financial education.

If you’re wondering how to teach kids about money management from an early age, you’re in the right place. This comprehensive guide will walk you through age-appropriate strategies, practical tools, and expert tips to help your kids develop smart money habits that last a lifetime.

Introduction

Why Teaching Kids About Money Management Is Crucial

Money management is a life skill, not just a school subject. Kids who understand how to earn, save, spend, and give money wisely tend to have less debt, better credit, and stronger financial futures. Teaching these skills early reduces anxiety and sets your child up for success.

Common Financial Mistakes Adults Make Due to Lack of Early Education

Many adults get into trouble because they don’t know budgeting, saving, or the dangers of credit misuse. The good news? These mistakes are avoidable with the right guidance in childhood.

What You’ll Gain from This Guide

You’ll learn how to introduce money concepts at every stage of childhood, use fun and effective tools, and build financial habits that empower your child through life.

Understanding the Basics of Money Management for Kids

What Is Money Management?

At its core, money management means making informed decisions about how to use money to meet needs and achieve goals. For kids, it starts with understanding that money is a tool, not just something to spend.

How to Teach Kids About Money Management from an Early Age

Mastering how to teach kids about money management from an early age means breaking down complex ideas into simple lessons children can grasp and practice.

Age-Appropriate Financial Concepts

Young children learn best through concrete experiences, while older kids can handle abstract ideas like budgeting and investing.

Setting the Foundation: Teaching Young Kids (Ages 3-7)

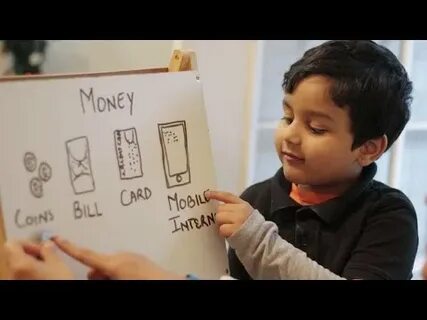

Introducing the Concept of Money

Start with basics: show coins and bills, explain their value, and play counting games.

Using Play to Teach Money Skills

Pretend store or bank games teach the idea of exchange and saving.

Simple Activities to Build Awareness

Use clear jars to separate money for spending, saving, and giving.

Teaching Elementary-Aged Kids (Ages 8-12) About Money

Explaining Saving, Spending, and Sharing

Use stories and real examples to show why saving is important, when spending makes sense, and why sharing matters.

Introducing Allowances and Budgeting

Set up a regular allowance and help kids divide it into categories.

Using Real-Life Experiences and Games

Take kids shopping and discuss choices or use educational board games about money.

Money Management for Teens (Ages 13-18)

Teaching About Earning Money

Encourage part-time jobs or entrepreneurial projects.

Managing a Bank Account and Digital Payments

Open savings or checking accounts and explain online banking basics.

Credit, Debt, and Responsible Borrowing

Discuss how credit cards work, interest, and the risks of overspending.

Effective Tools and Resources to Teach Kids About Money

Books and Educational Apps

Titles like The Everything Kids’ Money Book or apps like PiggyBot make learning fun.

Money Jars, Piggy Banks, and Visual Aids

Physical tools make abstract concepts tangible.

Family Financial Discussions

Normalize money talk to build comfort and curiosity.

Role Modeling and Setting Good Financial Habits

Leading by Example

Kids imitate parents—demonstrate good habits yourself.

Involving Kids in Family Budgeting

Show them how you plan spending and saving for goals.

Encouraging Questions and Open Conversations

Create a safe space for financial questions and learning.

Using Allowances to Teach Financial Responsibility

One of the most practical and effective ways to teach kids about money management is through a well-structured allowance system. Giving children an allowance isn’t just about handing over money—it’s about providing a hands-on, real-world platform where they can learn financial responsibility, decision-making, and goal-setting. Here’s why allowances are so powerful and how to use them to build lifelong money skills.

1. Allowances Create a Safe Space for Learning

An allowance gives kids their own money to manage, which means they can make spending and saving decisions independently—but within a controlled environment. This “practice money” allows them to experience consequences without serious risks.

For example, if a child spends all their allowance on candy early in the week, they learn to wait until the next allowance to buy something else. This trial-and-error process is invaluable for understanding budgeting and delayed gratification.

2. Teaching the Value of Money Through Choice

When kids receive an allowance, they must decide how to use it. This introduces the concept of opportunity cost: choosing one thing means giving up another. Whether it’s buying a toy, saving for a larger purchase, or giving to charity, kids learn that money is limited and choices matter.

Parents can encourage children to think critically about purchases by asking questions like, “Is this the best use of your money?” or “What else could you save for if you don’t buy this now?”

3. Encouraging Saving and Goal Setting

An allowance naturally opens the door to teaching saving habits. Kids can be encouraged to divide their money into portions for spending, saving, and sharing. This teaches budgeting basics early on.

Helping kids set savings goals—like buying a bicycle or a video game—adds motivation and a sense of achievement. Visual tools such as savings jars or charts can make the process fun and tangible.

4. Teaching Delayed Gratification

Delayed gratification—the ability to wait for a bigger reward—is a key skill linked to financial success. An allowance system reinforces this by encouraging kids to save over time rather than spending impulsively.

For instance, rather than buying a small toy immediately, a child might save for several weeks to purchase a more meaningful item. This builds patience and planning skills.

5. Introducing Concepts of Earning

Allowances don’t always have to be unconditional. Linking allowance to chores or responsibilities teaches kids that money is earned, not just given. This connection fosters a strong work ethic and appreciation for money’s value.

However, it’s important to balance chores that are part of family duties (done without pay) with extra tasks that earn allowance, to avoid confusing expectations.

6. Teaching Accountability and Record-Keeping

Encourage kids to track their spending and savings using simple ledgers or apps. This habit builds accountability and helps them understand where their money goes.

Periodic “allowance reviews” can be opportunities to discuss choices, celebrate savings, and adjust plans.

7. Avoiding Pitfalls: Over- or Under-allowing

Setting the right allowance amount is crucial. Too little money limits learning opportunities; too much can encourage wastefulness. Consider your family budget, your child’s age, and what expenses the allowance should cover (toys, snacks, outings).

Clear guidelines help manage expectations and foster responsible behavior.

8. Allowance as a Foundation for Financial Independence

By managing their allowance, kids gain confidence in money decisions, which prepares them for larger financial responsibilities like managing bank accounts or part-time job earnings during their teenage years.

Allowance management is a stepping stone to financial independence.

Practical Tips for Implementing an Effective Allowance System

- Be Consistent: Pay allowance regularly, whether weekly or monthly, to teach budgeting around fixed income.

- Use Separate Jars or Envelopes: Designate funds for spending, saving, and giving to reinforce money management skills.

- Discuss Financial Goals Often: Help kids adjust goals as they grow and their interests change.

- Model Good Behavior: Share your own budgeting and saving stories to inspire.

- Celebrate Milestones: Praise good saving habits and smart spending decisions to reinforce positive behavior.

Using allowances thoughtfully transforms money from a mysterious abstract concept into a practical tool for learning responsibility, planning, and making wise choices. It’s a simple yet powerful method to prepare kids for a lifetime of healthy financial habits.

Incorporating Technology in Teaching Money Management

Kid-Friendly Banking Apps

Apps like GoHenry allow controlled spending and saving.

Online Games That Teach Financial Literacy

Games like Money Metropolis make learning engaging.

Monitoring and Guiding Digital Spending

Set limits and discuss online money safety.

Common Challenges Parents Face When Teaching Money and How to Overcome Them

Dealing with Impulsive Spending

Teach impulse control through goal tracking and rewards.

Avoiding Money Taboo Topics

Be open and honest to remove stigma around money talk.

Balancing Fun and Responsibility

Mix playful learning with serious lessons.

Encouraging Entrepreneurship and Earning

Simple Business Ideas for Kids

Lemonade stands, pet sitting, or crafts teach earning.

Teaching the Value of Hard Work

Link effort with rewards to build a strong work ethic.

Managing Earnings Wisely

Help kids budget and save from their earnings.

The Importance of Teaching Giving and Charity

Teaching kids about money isn’t just about earning, saving, and spending wisely—it’s also about instilling a sense of generosity and social responsibility. When children learn early that money can be a tool to help others, it shapes their character, builds empathy, and fosters a more compassionate outlook on life. Here’s why teaching giving and charity is a vital part of money management education.

1. Instilling Empathy and Compassion

Giving teaches kids to recognize the needs of others and understand different life circumstances. It moves their focus beyond personal desires and helps them develop empathy. When children donate a portion of their allowance or time, they begin to grasp the impact of kindness and the difference they can make in someone else’s life.

For example, encouraging kids to give to a local food bank or a charity that supports children in need helps them connect their money with real-world challenges. This emotional connection fosters a lifelong habit of caring and generosity.

2. Balancing Materialism with Purpose

In a consumer-driven world, children can quickly equate happiness with possessions. Teaching charity helps balance this by showing that true fulfillment often comes from giving, not just receiving. Kids who practice giving are less likely to develop materialistic attitudes and more likely to value experiences, relationships, and community.

It shifts the money mindset from “How can I get more?” to “How can I use what I have to make a positive difference?”

3. Building Financial Discipline and Priorities

Allocating a portion of money for giving encourages thoughtful financial planning. When kids know they must set aside money for charity, they learn to prioritize spending and saving accordingly. This practice reinforces budgeting skills and delayed gratification.

Moreover, deciding how much to give and choosing causes cultivates decision-making and goal-setting skills. It also opens conversations about fairness, needs versus wants, and responsible money use.

4. Encouraging Social Awareness and Active Citizenship

Charitable giving connects kids to their communities and the world at large. It raises awareness about social issues such as poverty, education, health, and the environment. Children who engage in charity are more likely to become socially conscious adults who volunteer, advocate, and contribute positively to society.

Teaching giving is not just about money—it’s about fostering active, informed citizens who care about their neighbors and the planet.

5. Reinforcing Positive Family Values and Traditions

Giving together as a family strengthens bonds and creates shared memories. It provides an opportunity to discuss family values around kindness, gratitude, and generosity. Celebrating charitable acts or setting family giving goals encourages consistency and models the behavior for younger siblings.

These traditions often become cherished rituals that children carry into adulthood, shaping their lifelong financial and ethical habits.

6. Enhancing Emotional Wellbeing

Studies show that giving activates the brain’s reward centers, releasing feel-good hormones like dopamine. Kids who give tend to experience increased happiness, self-worth, and connectedness. Teaching charity thus contributes to emotional and psychological wellbeing.

Helping kids experience the joy of giving creates positive associations with money management that go beyond numbers and budgets.

Practical Ways to Teach Giving and Charity

- Set Aside a “Giving Jar”: Encourage kids to regularly contribute a portion of their allowance or earnings to this jar for donations.

- Choose Causes Together: Let kids pick charities or community projects they care about, increasing their personal investment.

- Volunteer as a Family: Participating in hands-on activities like food drives or community clean-ups deepens understanding.

- Discuss Impact Stories: Share stories about people or animals helped by donations to illustrate giving’s real effects.

- Celebrate Giving Milestones: Acknowledge and praise acts of generosity to reinforce positive behavior.

Teaching kids about giving and charity enriches their money management education by blending financial skills with heart. It prepares them not only to be smart with money but also kind, responsible, and generous adults who contribute meaningfully to the world.

Financial Education in Schools: What’s Missing and How Parents Can Fill the Gap

Overview of Current Curriculum

Many schools lack comprehensive money lessons.

Supplementing With Home Education

Parents can introduce real-life money skills at home.

Advocating for Better Financial Literacy

Get involved in school programs and policy.

Measuring Progress and Celebrating Financial Milestones

Setting Financial Goals with Kids

Help children set achievable money targets.

Recognizing Achievements

Celebrate saving milestones and wise choices.

Keeping Motivation High

Use positive reinforcement and fun rewards.

Conclusion

Teaching kids about money management from an early age lays a foundation for lifelong financial success. Starting simple and growing with your child’s understanding ensures they develop healthy habits and confidence around money. Remember, the best lessons come from combining education with real-world practice and open conversations. So start today, stay patient, and watch your kids grow into financially savvy adults ready to take on the world.

FAQs

1. At what age should I start teaching my child about money?

You can start as early as age 3 by introducing coins and basic money concepts through play.

2. How much allowance is appropriate for kids?

Allowance depends on your family’s budget; start small and increase as kids grow and show responsibility.

3. How do I talk to my teenager about credit cards?

Be honest about benefits and risks, explain interest, and set clear expectations for responsible use.

4. What are the best apps for teaching kids about money?

Apps like GoHenry, PiggyBot, and iAllowance are popular for hands-on learning.

5. How can I encourage my child to save rather than spend?

Help them set clear savings goals and celebrate achievements to build motivation.